The nagging question as you're about to hand over $100,000 for a set of keys...

“Do I actually know what I'm doing?”

Countless investors fail because they don't have a system.

They dive in uneducated and throw spaghetti at the wall to see what sticks.

They make easily-avoidable mistakes that cost them thousands.

They fly by the seat of their pants and buy the wrong property in which the numbers don't work, and they have no idea.

Enrollment closes soon:

You missed out!

Real estate investing can be an incredibly lucrative pursuit...

It has the power to shave years off your retirement timeline, when done right.

But the road to success is littered with potholes and hazards, each one threatening to wreck you.

And most investors go in driving blindfolded.

Making mistakes that they'd spot, if only they had the right training and a system to follow.

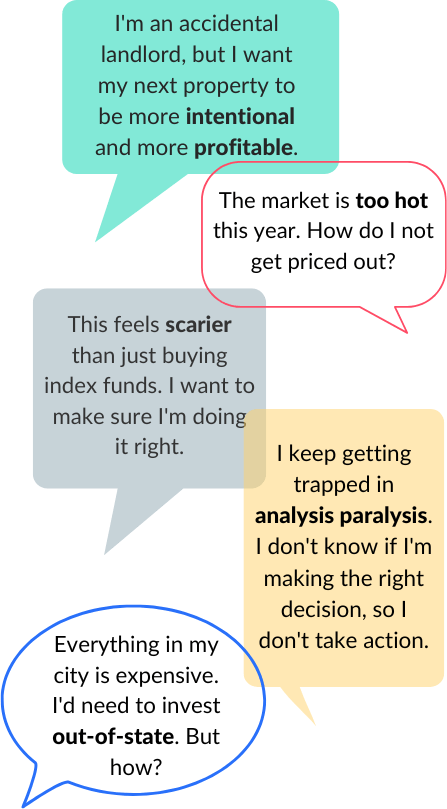

Any of this Sound Familiar?

If you...

Waste hours

Trying to find any properties that meet the one percent rule and come up short...

Keep checking Zillow

And see everything keep going up and up and up...

Thought about making an offer

But everything gets snapped up in a day — at more than asking price!

Look back and kick yourself

Thinking, "if only I'd bought that property back in 2017..."

It's that moment at 2am, when you can't sleep, and you pull up a property on Zillow that you almost bought back in 2017... But that you passed up.

And now you see the returns it's generating — returns that could have been yours.

You see another investor reaping the rewards you could have had...

...If only you had taken action.

“Participating in YFRP was like having a super-knowledgeable (and fun!) mentor by my side, walking me through the process of acquiring a rental property, step by step and concept by concept.

The information was rolled out in an incredibly well-thought-out sequence and in manageable chunks, so that I never felt overwhelmed.

YFRP is the next best thing to having a savvy real estate investor and educator on speed dial.

You're going to get lifetime value from this course, and the sooner you begin, the sooner you'll have the power of real estate assets working for you!

I initially signed up for the course in 2018 and continue to receive lots of value from the course all these years later. Thanks Paula!”

Danielle P.

If only losing out on potential returns was the worst of it...

The worst of it is when the day comes that you decide you're sick of waiting.

You say, "screw it," you go out and buy a property, despite having doubts that you don't know what you're doing.

You're at the closing and the lender asks you to sign on the dotted line, and you wonder to yourself, "is this rental property actually going to work out?"

You move ahead with no framework and no system and you're blindsided by expenses left and right. Each one eating into the returns you thought you'd be making.

Six months later, you look at the numbers, and your stomach drops...

You see that even with this property fully rented, it's costing you more money than it's making each month...

...and now you're spending money out of your pocket every single month just to keep it.

Instead of accelerating your early retirement, suddenly you find yourself with a money pit that's delaying it.

"Do I know what I'm doing?"

Fear of making a six-figure mistake is the #1 thing that holds so many would-be investors back.

And can you blame them?

It's scary to commit to such a large investment.

If you buy a few shares of a stock and it fails miserably, you lose a few hundred dollars.

If you buy the wrong rental property, you lose $10,000+.

And if you're out there just guessing, you'll always be haunted by that question... "Do I know what I'm doing?"

...wondering which "unknown unknown" is going to be the one that comes out of nowhere and sinks you.

When all you're doing is learning little disconnected tidbits here and there from podcasts or blogs, it's easy to get stuck in analysis paralysis....

...Never knowing when you're actually ready to start.

The solution:

A comprehensive, proven system to execute.

Which brings us to...

Being a smart investor.

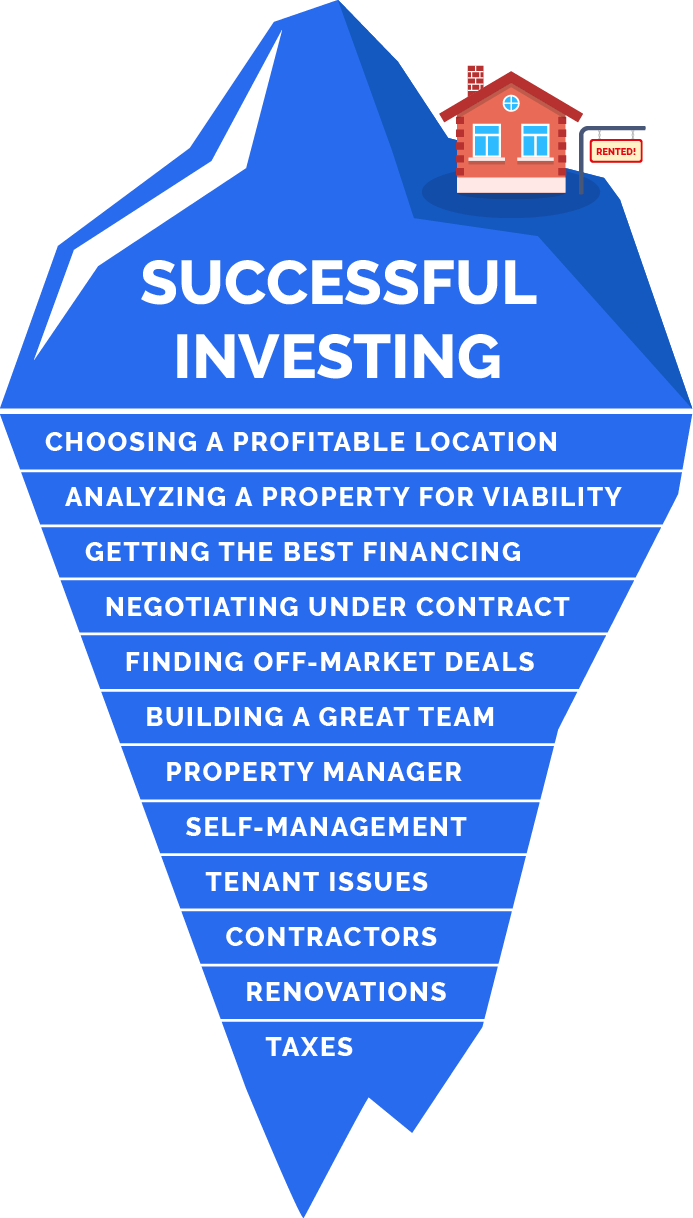

Successful real estate investing is strategic.

It's about following a system and running the right formulas.

It's about knowing exactly how a property's going to work, before you sign on the dotted line.

- The most successful investors know that a stress-free, hands-off property with reliable tenants who pay on time is the result of a methodical process.

A process that ensures you understand exactly how to choose the right property in the first place...

And navigate all the challenges that will come up along the way to getting those first tenants.

A process that you can run again and again.

To go from your first rental property...

To your second...

To your third...

To your {insert your target number of rental homes here}.

Saved me thousands on avoided mistakes...

Paul H.  Owns 6 units

Owns 6 units

“If you're on the fence about YFRP, join! You'll be glad you did it.

I would estimate that the knowledge gained in the course has saved me thousands on avoided mistakes.

The course showed me how to analyze opportunities, and now each new deal I do is even better than the last (higher cap rate/cash flow).

Spending money on the course also helped financially motivate me to get started and follow through so I didn't 'waste my money.' ”

Smart investing is the result of understanding:

How to analyze a property and see its current and future potential, as well as potential risks that would slip under most investors' noses.

How to find the right property in an investor-friendly neighborhood that will yield a great ROI.

How to get fantastic deals on financing and get lower rates than what uneducated investors choose.

All the construction and renovation jargon and being able to talk with contractors and conduct strategic renovations on your properties to increase their monthly cash flow.

How to negotiate great deals, including negotiating after you're under contract.

How to build a highly-skilled team that allows you to run your rentals as a passive, hands-off business.

How to screen for wonderful tenants to get reliable tenants who pay on time, instead of nightmare tenants who trash the place.

But quite frankly, real estate investing can feel... scary. (#understatement of the year)

There's so much to know and remember at every stage of the process, and the stakes are so high.

It's vital to have a framework to follow and a reference guide that you can lean on at every stage of the process.

Which is why I built Your First Rental Property.

I was legit scared...

Virginia M.

“I am so grateful for YFRP. Paula and the team have created a valuable resource that I would encourage any of my friends to utilize.

I was legit scared to invest in rental real estate before the course, and I now understand it infinitely better. Thank you!”

The confidence to actually get started investing

Noel H.  Now owns 5 units

Now owns 5 units

“Before joining YFRP, I was scared about having no idea what I’m really getting into and things going terribly wrong.

My biggest success from the course has just been the confidence to go out and do it.

After hearing about others succeeding for years and not knowing where to start, the YFRP course gave me step by step instructions on how to do it.”

48.18%

The portion of YFRP students from a recent survey who’ve already gone on to buy one or more rental properties.

This is why we call YFRP the

"Decimator of analysis paralysis."

Your First Rental Property (YFRP) is made for investors who want to build passive income ethically.

While following a methodical, smart, structured framework.

Who need a proven, tested system that works.

YFRP asks... What do you need to know right now?

Then walks you through exactly how seasoned pro investors do it.

So you learn processes so tested and methodical...

That you'll know exactly what to do in any given situation.

Introducing...

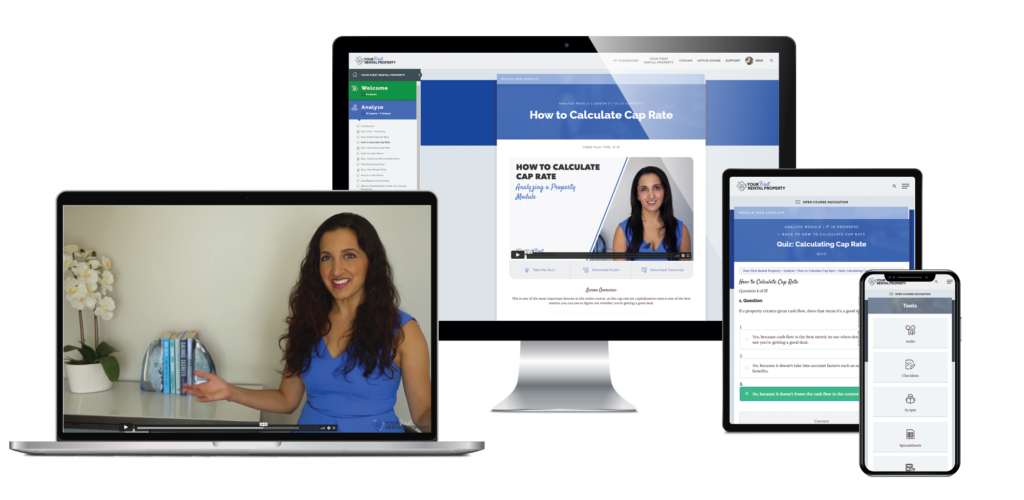

I know you want a comprehensive and step-by-step framework.

But I also know how time-strapped you are.

That's why we've structured the course so that you can take action as you learn, to maximize your time in the market.

You'll also get lifetime access, so that you can use YFRP as a reference guide to pop in and get whatever you need, exactly when you need it.

From finding a property, to analyzing, to financing, to renovating, negotiating, building a team, and managing tenants.

You'll also find a suite of checklists and tools that make complicated processes easy and quick.

Need to hire a real estate agent? No problem, just pop in and grab the interview checklist.

(No more spending a day googling all the things you need to know first.)

Need to see all the steps for a tenant move-in/out? Piece of cake. There's a checklist for that too.

Aaaaand that's not to mention our exhaustive support. You'll have access to seasoned investing experts ready to answer all your burning questions.

Here's the thing...

You're always going to be busy. Make the most of your precious time by efficiently getting all of your knowledge from one place.

YFRP saves you time. Allowing you to shortcut countless hours of research with our templates, word-for-word call scripts, checklists, spreadsheets, and more.

YFRP gives you a comprehensive, systematic framework for building a portfolio of profitable rental properties.

Join 2,300+ other students getting off the sidelines and into their first rentals.

Don't spend another year watching the market climb while you sit there kicking yourself wishing you'd gotten started.

I appreciated Paula's focus on frameworks of thinking about a problem vs. "here's an answer with no context on how I arrived there."

The amount of value is incredibly immense. The lessons covered a lot when I first joined, and they continue to be added to.

Also the fact that I can come back to the course at any time and reach out to the community there means I can go at my own pace.

- Maria P.

Core Curriculum

We kick off with the analyzing module, which will immediately arm you with the knowledge and tools you need to avoid making a six-figure mistake.

Module 1

Analyze

Your success as a real estate investor depends on choosing the RIGHT property — but how can you spot the difference between a great investment and a dud?

Learn the formulas that pros use, develop systems to compare properties against each other, and understand how to estimate rent, repairs, and the rest of the financials.

You'll no longer sit around wondering if a given property is a good deal — you'll have the tools and framework to know.

❝

"The Analyzing modules and the Manage modules were my favorites, because I felt they really addressed the areas I felt insecure with. Like, how to you actually go about the processes. I'm beginning to feel more confident that this is something I can do, rather than just a dream."

– Allison, New Jersey

❝

"The analyze module is extremely helpful because it helps an investor problem frame in a logical way. Ultimately, it results in a holistic approach to rental property investing."

– Benjamin, Georgia

❝

"We wanted a system for finding properties and knowing what to consider when looking at it.

YFRP gave us a structured way to approach all of the topics we need to understand when considering entering the rental property business. We are happy that we could go through the course at our own pace and we can also go back to the course at any time to reference what we've learned."

– Emily U.

❝

“This course is a best-in-class educational resource for individual investors interested in rental property investing.”

– Amanda O. – Now owns 1 rental property

Module 2

Find

Finding a great rental property feels impossible. Everything in your area is expensive, and deals are getting snapped up quickly for stupidly high prices.

Learn the strategies that real estate pros and sophisticated investors use to find amazing deals in any market.

Whether you're househacking or investing out-of-state (or unsure!), you'll discover how to find amazing deals that will make your friends say, "whoa, how did you find that?!"

Module 3

Finance

Choosing the wrong type of loan with a difference of a few percentage points can cost you thousands.

Learn about all the different financing options and which makes sense for you. You'll also learn...

You'll walk away with a clear plan for the amount and type of financing that's right for you.

❝

“I can't imagine how much money you saved me by avoiding buying the wrong property and not overpaying...

Actually, the simple truth: I would have not bought it, period, because I would have never thought that I'd have enough money to even start this.”

– Barbara V., Florida

❝

“If you’re thinking about joining YFRP, do it! You won't regret it - there's no where else that you'll get this level of detail and information, this level of realistic, targeted support, and this level of thinking about real estate investment.”

– September G. – Now owns 2 units

❝

"The biggest thing I've taken away from the course so far: The importance of forced appreciation and not being afraid to take up property renovations. The course is amazing and extremely helpful for first time investors."

– Kajal L.

❝

“If you are thinking of investing in real estate or are new and need some guidance, this course is a very valuable for getting started.”

– Jess M. – Now owns 3 rental units

Module 4

Renovate

Uneducated investors leave themselves blind to potentially getting taken advantage of by contractors, or buying a home that's due for expensive problems down the line.

The Renovate module is all about how houses are built, what goes into the price of a renovation, and how to add value to a property in a way that increases your monthly cash flow. You'll learn how to...

You'll know how – and by how much – to renovate your rentals, and no longer feel overwhelmed by the "contractor jargon" as you execute your renovation projects like a pro.

Module 5

Negotiate and Buy

Not understanding the negotiation and buying process causes many uneducated investors to overpay and waste money.

Time to make an offer! Negotiating for the property, performing inspections, and navigating the home purchasing process can be complicated... that's why this module creates clarity and simplicity, and provides strategies to put you in a position of strength.

You'll learn how you can potentially save thousands by negotiating better deals.

You'll leave this module with mastery of the negotiation and buying process.

❝

“Paula's advice that 'The asking price is the asking price' gave me the courage to go in with an offer that was $130,000 under — and it was accepted!

– Tara S., Springfield, TN

❝

“Purchased a 4 plex that’s performing spectacularly!”

– Daniel F.

❝

"I feel I got lot of value from YFRP and the I like the continued support.

It’s given me more confidence. I chose an area, formed a team, and am currently analyzing properties."

– Maritza H.

❝

"I feel I got lot of value from YFRP and the I like the continued support.

It’s given me more confidence. I chose an area, formed a team, and am currently analyzing properties."

– Maritza H.

Module 6

Build a Team

Choosing the wrong team can mean poor returns, crappy tenants, and constant demands on your time.

You know you'll need the support of a great team. But how can you find and manage this team — especially if you're a long-distance investor? This module will teach you how to...

You'll leave this module with a clear plan of how to build a team of rockstars that will allow you to run your rental business hands-off as a passive investment.

Module 7

Management and Tenants

Many uneducated investors fail to screen out poor tenants who pay late – or don't pay at all – and trash their rental property.

You've closed the deal. Now what? Time to either hire a property manager or find tenants yourself. But how do you begin? This module will teach you how to...

You'll walk away from this module confident in how to run the day-to-day operations of your rental, and with a plan for getting it filled with wonderful tenants.

❝

“The course is just so comprehensive that when you try to learn it and take all the quizzes and you're engaging with the course material, you level up your knowledge so much faster than you possibly could have if you were doing this all on your own and trying to figure it out as you go.”

– Kelsey K.

❝

“Fundamentally, YFRP is some serious value.

I love that I can come back to it as reference material whenever I need to (and I have several times even a year later!).

And I still connect with folks in the course forums.”

– Bob C. – Now owns 2 units

A learning experience customized for you.

Lifetime access to all curriculum, bonuses, and support available.

YFRP will be available as a resource for you for your entire investing journey when you choose the lifetime purchase option.

Every lesson available in video, audio, and text format.

Learn in the way that works best for you.

Quizzes to test your knowledge as you go.

(Answer key pinpoints the EXACT spot in the transcript where you'll find the solution.)

Astonishing support to ensure you have help at every step.

You'll always have your questions answered.

Included:

spreadsheets, templates, word-for-word scripts, and other tools to help you solve any problem – at a moment's notice – including...

Our mega analyzing spreadsheet. Find out all the ways that a rental property can build wealth... Hint: it's way more than you think. (Many students have told us this spreadsheet alone is worth the price of the course!)

Repair costs estimator spreadsheet. Get an accurate idea of how much it's going to cost you to maintain the property to ensure your expectations are aligned with reality

Rent estimator spreadsheet. Get crystal clarity on how much rent you can bring in with a property.

Step-by-step neighborhood finding checklist. Implement Paula's exact process for choosing a neighborhood to invest in

Open house checklist. Ensure you're fully prepared for an epic showing to attract the best tenants.

Script: 6 questions to ask a real estate agent. Make sure you pick the right agent.

Script: 14 questions to ask a property manager. The property manager is the backbone of your hands-off rental business. This script ensures you pick the right one.

"Killer listing" template. Write an awesome listing that will attract top tenants.

Photography guides and camera accessories FYI-sheets. Ensure you show off your listing in the best possible way.

... And 45+ more downloadable checklists, word-for-word phone scripts and email scripts, spreadsheets, templates, worksheets, transcripts, audio, and FYI-sheets.

The support you need:

Ask Paula anything

Live on zoom

While class is in session!

Every YFRP cohort gets access to several live office hours Q&A calls with Paula!

You ALSO get lifetime access to all future cohort live office hours AND instant access to our searchable recordings vault of ALL 60+ past office hours sessions.

Your investing community. There for every hurdle.

And every success.

As a YFRP student, you get lifetime access to an absurd amount of support...

Office hours with Paula — Live coaching calls over the course of the semester allow you to get your questions answered directly by Paula on Zoom. If you choose to enroll with the lifetime access option, you also will get lifetime access to FUTURE live coaching calls with Paula in later semesters of YFRP.

Bonus: You'll also have access to our entire searchable library of 60+ past office hours recordings.

Full-time course administrator — Jethro's job is running the course, overseeing the Teachers Assistants, and keeping the course content valuable and updated.

6 Teachers Assistants — Our TAs work rotating shifts, constantly watching over the forums to ensure students get their questions answered within a day or two.

Study halls — Live TA-led sessions to do a deep-dive into course content and walk students through our resources.

Active investor mastermind calls — Live TA-led sessions that address challenges & questions students are running into as they're executing on what they've learned and are in the active investment process.

Top-notch community platform — We've worked with a best-in-class developer to build our forums on the best forum software in the world.

We've also integrated our forums with our Invest Anywhere tool to get you boots-on-the-ground knowledge about cities you're looking to invest in.

Learn alongside peers — We limit our enrollment periods so that students are learning alongside each other and able to make connections & discuss the content with peers in the forums.

“I was not anticipating how valuable the community would be. That was definitely one of my biggest surprise sort of benefits: how much I learned from the other students and from the TAs.

It was really helpful, and gave me confidence and willingness to move forward and actually make an offer, take the risk, and jump in.

It was great having the support of all the other people who were right there with me, and I knew I could plug into the community with any questions or concerns that came up and that I'd be able to get input and feedback really quickly.”

Amanda A,

Boston, MA

About your instructor, Paula Pant

founder of Afford Anything & head instructor of YFRP

I've been investing in rental properties for a decade; I've been an out-of-state investor for six years.

Over that time, I've built a portfolio of 7 rental units that are now free and clear.

But I've learned a lot of lessons the expensive way, through the School of Hard Knocks.

I'd like to save you from repeating those same struggles.

I'd like to share the benefit of the wisdom, observations and lessons that I've accumulated over time.

That's why I built YFRP — to give you access to the course I wish I had when I was starting out.

To give you the knowledge and framework you need to accelerate your early retirement and avoid making six-figure mistakes.

Paula and her work have been featured 170+ times (we stopped keeping count after that) in industry-leading publications and news outlets.

Including Oprah, MONEY, CNBC, Forbes, The Washington Post, MarketWatch, USA Today, Fast Company, Inc, Bloomberg Business, U.S. News, Fortune, Lifehacker, Yahoo Finance, Business Insider, Nerdwallet, The New York Times, and countless others.

Paula is remarkable for two reasons. First, she’s one of only a few female bloggers in a niche dominated by men. Second, Paula focuses almost exclusively on making money instead of saving it. Her blog is about building wealth, with a particular focus on rental properties. She’s sharp, and she now has me as a subscriber.

– J.D. Roth

Get Rich Slowly

Meet Our Amazing Teacher's Assistants!

All of our Teacher's Assistants are alumni of the course. They've been exactly where you are, and they can't wait to help you along your real estate journey! They hang out in our forums to respond to questions within 24-48 hours, and they also host our Active Investor Mastermind calls.

Sam enrolled in our Spring 2019 cohort and joined our Teacher's Assistant Team in Spring 2020! In early 2020, she purchased a duplex that she spent several months househacking.

Since moving in with her partner, she's now looking at selling and investing out-of-state.

Karen owns five rental properties (one of which is a duplex) and was one of our first Teacher's Assistants back in Fall 2019! She and her husband are currently figuring out where they want to invest next - their rentals are located in Las Vegas, NV, Pittsburgh, PA, Portland, OR, and Alabama.

Amanda enrolled in our Fall 2020 cohort and bought her first rental property (a 4-plex in Vermont) just a few months after graduating! She lives outside of Boston, MA with her husband, toddler daughter, and two rescue dogs.

Cory is an operations manager who lives outside of Tempe, Arizona. He is an alumnus of the fall

2023 cohort, during which he closed on his first property, an SFR in Nevada.

Fun fact: Cory's favorite module in the course is the team module. He particularly enjoys the

unpaid and paid team lessons, which reflect the importance of motivation and teamwork.

Here's the truth...

Being an educated investor has a direct impact on your returns. Your retirement timeline. Your risk.

The closest thing to hand-holding you can get.

Allison B.

“The course was incredibly thorough, clearly well crafted and the closest thing to hand-holding you can get. The support on the forums was also really wonderful.”

YFRP is my first recommendation.

Hailey R.

“I consider this the best resource for anyone wanting comprehensive coaching or foundation on how to approach rental property purchases. It is my first recommendation to anyone wanting to pay for a resource.”

My husband became 100% as involved as me in this journey.

Leah V.

“We have purchased 3 properties this year. The biggest impact though was getting me and my husband on the same page. I listened to the afford anything podcast alone, as well as others. But my husband watched every second of the course with me and took notes with me. My husband became 100% as involved as me in this journey.”

Your knowledge as an investor makes or breaks your real estate returns.

The right education moves the needle. You decide how far.

How much could these types of skills be worth to you and your financial independence timeline?

Negotiating a deal down by $10,000+ after you're already under contract because you know how to leverage the information in the inspection report

Spotting when a contractor is trying to charge you an extra $5,000 beyond the scope of work

Knowing how to spot red flags on a tenant application to filter out tenants that will trash the place and land a "dream tenant" who's reliable, low maintenance, and pays on time

Knowing where to look (in a hot market where everything's expensive!) to find a good single family home for $80,000 in a safe, landlord-friendly area

Spending $8,000 on strategic renovations for your rental that raise its value by $12,000

Getting access to an interest rate that's significantly lower than what your lender first suggests that you might have otherwise blindly agreed to

Getting access to "hidden deals" on non-MLS properties that allow you to save $20,000+

YFRP empowers you to make the right decisions to earn and save thousands of extra dollars.

Which makes it a high-return investment.

The course has had a 3000% ROI for me...

Drew H.  Owns 1 rental property

Owns 1 rental property

“YFRP lays out a clear process for finding, funding, fixing and managing rental properties. The course has had a 3000% ROI for me compared to if I had never joined.”

The analyzing spreadsheet alone has saved me thousands of dollars...

Rob C.  Now Owns 14 units

Now Owns 14 units

“I have taken several other classes like this but none is as comprehensive or as good a value.

The analyzing spreadsheet alone has saved me thousands of dollars and giving me the confidence to know that I am underwriting a deal the way a professional would”

Better than classes that cost 10x more...

James G.

“I wanted a systematic approach to investing into Single Family Real Estate with an amazingly talented and experienced instructor.

I’ve been doing it for many years wondering if there was a better way.

YFRP is that better way! Absolute best compared to classes which cost 10x more.”

So just to recap, you get...

Fast Action Bonus

Get 3 months of FREE access to our newest course, Your Next Raise

Enroll by October 22nd and get 3 months of Your Next Raise at no additional cost (an $87 value).

Your financial plan is only as strong as your income. While YFRP helps you make the most of what you earn, Your Next Raise ensures you're earning what you're worth in the first place.

Here's what you'll get:

- Live practice sessions where you'll actually negotiate (not just read about it)

- Real-time feedback on your negotiation approach

- Community support from others actively working on salary increases

- Skills that compound -- every raise you negotiate affects your lifetime earnings

The timing makes sense: Build your financial foundation with YFRP while simultaneously increasing the income flowing into that foundation with Your Next Raise.

This bonus ends October 22nd at 11:59 PM. After that, you'll still get full access to YFRP, but the 3-month Your Next Raise bonus disappears.

Two programs. One investment in your financial future. But only if you enroll now.

Time left to secure 3 free months inside Your Next Raise.

0:00 — You missed out!

Enrollment closes soon:

You missed out!

How Much is Tuition?

There are two options for your enrollment in Your First Rental Property.

The first and most popular option includes lifetime access to the course material and lifetime support from our team.

One-Year Access Pass

One-year access, risk-free guarantee

$1,297

(payment plans available)

Best Value

All-Access Lifetime Pass

Lifetime access, risk-free guarantee

$1,597

(payment plans available)

A cheat code to save $30k+

Drew H.

I wanted to minimize my risk in real estate investing by educating myself. $1297 is a cheat code to save $30k+ over my first few rental purchases.

Still on the fence? We have a 7-day, iron-clad

risk-free 100% Money-Back Guarantee

Over 2,500 students have upped their investment game thanks to Your First Rental Property, and I'm confident you will too.

However, if for any reason you're not blown away by the value of the content and how much you're short-cutting the learning process...

Simply email us at support@affordanything.com by November 7th and we'll quickly refund you every last cent.

Simple as that.

I was a little scared of the price at first, but I knew once I was committed to purchasing a home, that I needed to sign up.

I was really confused about how to even start looking for a home, what pitfalls to watch out for, how to navigate the loan landscape, and ultimately how to know I'm getting a good deal.

I've already recommended this course to multiple people. I would have paid double for this course after completing it.

Devon P.

Frequently asked questions

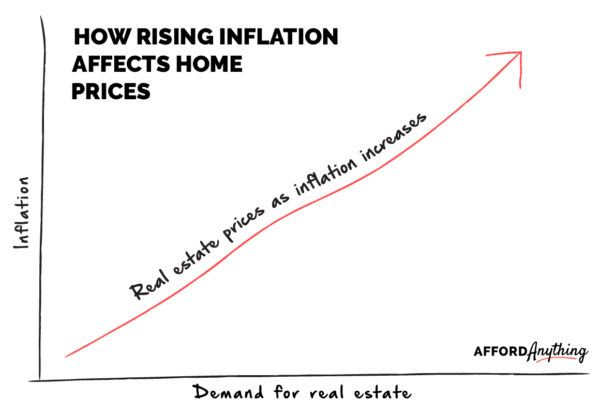

Yes! Real estate happens to be an excellent inflation hedge.

If you read my Inflation, Illustrated post, you learned that inflationary periods tend to punish holders of growth stocks (that’s why we’ve seen so much volatility in the stock market) and reward holders of tangible assets like real estate (residential, commercial, land), commodities (oil, natural gas, precious metals, wheat and corn), art, and jewelry.

This means that during inflationary periods, real estate prices tend to go up as people are looking for a good place to park their cash.

This is coupled with the already-hot market due to the housing supply shortage we’ve been experiencing for years.

(Are you starting to get an idea of why real estate prices are going up so much?)

Aside from the value of parking your cash in a tangible asset, there’s another benefit to getting into real estate in inflationary periods if you’re a borrower on a fixed-rate mortgage…

You essentially get to repay your mortgage with cheaper dollars due to inflation.

What this looks like…

— The bank gives you your $200k today to buy a rental property

— You put that money into a rental property that will likely increase in value as inflation increases (even though we primarily invest for the cash flow, not the capital appreciation)

— You pay the bank back with weaker dollars over time, but you were able to secure the full inflation-protected value of that house on day one.

So in other words, if you were to wait another year to buy a house, inflation alone would likely make it effectively cost more, since your money can buy less stuff in general.

This adds up to make now a great time to get started in real estate investing.

If you were to get started investing now, with a fixed-rate mortgage, you’d essentially get “triple-dipped” benefits…

- 1. An asset that performs incredibly well in inflationary periods

- 2. A locked-in fixed-rate mortgage that you secured before interest rates increased further

- 3. Repaying your mortgage with cheaper dollars

No! Fun fact:

Recession ≠ housing crash

A lot of people have it in their head that recession = a crash in the real estate market.

But if you pause and think about it critically, these two things don’t correlate.

A recession essentially means that companies are making less money.

A real estate crash essentially means that real estate prices are deflationary.

Quick definitions:

Inflationary = prices tomorrow are HIGHER than today. A bag of coffee that costs $5 today will cost $6 tomorrow.

Deflationary = prices tomorrow are LOWER than today. That bag of coffee that costs $5 today will cost $4 tomorrow.

If companies make less money, does this correlate with deflationary real estate prices?

Nope. It doesn’t.

During the 2008 Great Recession, the housing market specifically became deflationary.

In other words, a house that cost $500k in 2007 might have cost $400k in 2009.

This happened because flippers and speculators with irresponsible leverage became the market price-setters and were responsible for significant deal volume.

Flippers were flipping houses to other flippers, and the market grew due to artificial demand from these speculators hot-potatoing houses between each other.

When this hot-potatoing stopped (because mortgage-backed securities collapsed due to defaults, which dried up the free-flowing credit that these speculators were using to finance their flips), the demand for housing plummeted and we saw a crash in the real estate market.

This consequences of the crash – specifically, the subprime mortgage crisis – rippled out into the rest of the economy and caused a recession.

Quick comparison:

— 2008’s recession was caused by the subprime mortgage crisis.

— Today’s inflation (and potential recession) is caused, in part, by the forces of supply-demand shifting dramatically due to Covid, which led to stimulus payments and bond-buying — followed by subsequent belt-tightening — by the Fed

It’s temping to think that when one part of the market is deflationary (i.e. a real estate crash), it affects the entire market, and that everything becomes deflationary. But this isn’t true.

Certain sectors can experience inflation or deflation, and can experience it in a self-contained way that doesn’t ripple out and affect the whole market.

Think about technology — in the 80s, computers were extremely expensive. But thanks to constant innovation, technology tends to get cheaper over time, i.e. deflationary. It used to be that only very wealthy people could own a computer. Now, most Americans can.

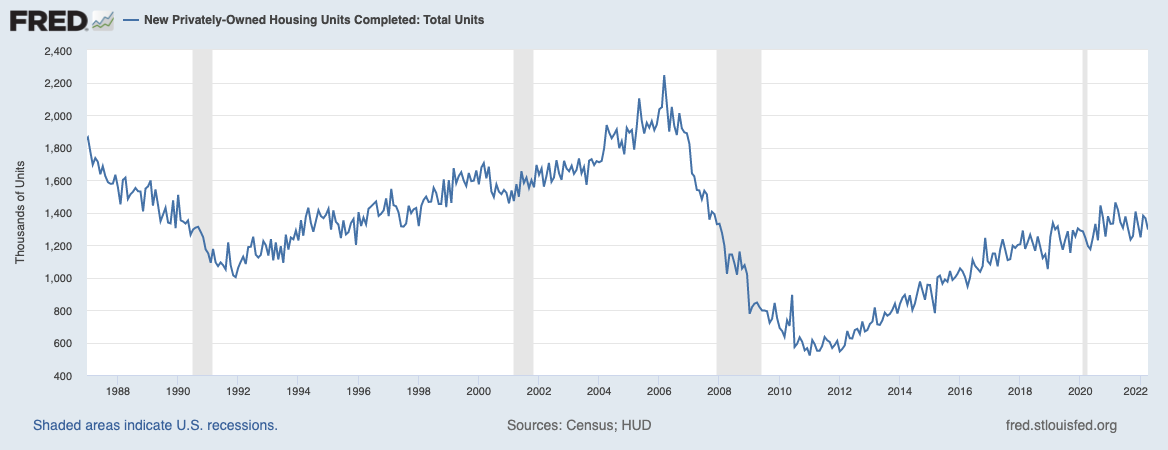

In 2008, we experienced a recession that was triggered by a subprime mortgage crisis. The supply of homes (built by speculators) exceeded demand, many major banks failed, and borrowing restrictions tightened. The cumulative effect of this was to exert deflationary pressure on the housing market, which led to a housing price collapse.

In 2022, by contrast, we’re living with the highest levels of inflation in 40 years, triggered in part by the bond-buying and balance sheet growth that the Fed undertook in order to spare us from the economic calamities of the pandemic.

The upstream supply cost of goods remains high: the cost of lumber is 80 percent higher now than it was pre-pandemic, partly due to the increased price of diesel (which is exacerbated by the war in Europe) and partly due to the need to pay higher wages, spurred by a labor shortage.

Homes in the U.S. are built in a lumber-heavy manner (as opposed to homes in some other nations, which are built primarily with concrete or cinder block.) When lumber prices in the U.S. jump by 80 percent, it’s no surprise that home prices climb along with it.

All of this is to say — the likelihood of deflationary pressure on the housing market is incredibly low.

Housing is likely to remain inflationary, meaning it’ll cost more tomorrow than it does today.

Takeaway: No, we’re not heading for a housing market crash.

“But Paula! The housing market crashed during the last recession. These two events are linked in my mind. Don’t recessions correlate with home price crashes?”

Fun fact! Historically, in many recessions, real estate did not become deflationary. In fact, it’s often been the case that real estate prices go UP in recessions.

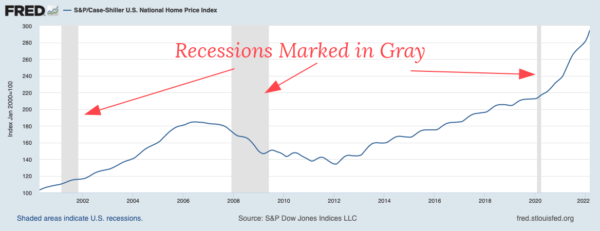

Here’s a chart of the Case-Shiller U.S. National Home Price index showing home prices over the course of our past 3 recessions. In 2 out of 3 recessions, home prices rise.

I hope now we’re on the same page that a recession does not directly correlate with home prices crashing (aka becoming deflationary.)

Far from home prices becoming deflationary, what we’re seeing now is the exact opposite.

We’re currently experiencing the most dramatic upward spike in the history of the Case-Shiller index.

And these soaring real estate prices are happening due genuine supply issues.

There are far more qualified buyers than the market can meet with supply.

There’s less of the speculative hot-potatoing we saw in 2006 prior to the crash.

For reference, let’s take another look at the chart from yesterday’s email of new housing completions — look at how much less housing is being built now than 2006. (something like 60 percent)

Meanwhile, there’s more legitimate demand now from owner-occupants (as opposed to speculators).

We also have record-low unemployment, and higher wages driven by inflation.

These factors combine to explain, in part, why prices are climbing so much.

That being said, does our potentially being in/headed for a recession change my mind about real estate being an awesome investment vehicle?

Not at all.

In short, the busier you are, the MORE you need a system you can follow to get results instead of having to waste time going down rabbit holes and learning lessons the hard way.

And I get it.

You’re super busy, with a million things on your plate on top of your day job, and you’re looking to build passive income, not take on a new side hustle that’s going to eat even more into your limited time.

I’ve laid out all the steps in the process to be implementable ASAP as efficiently as possible. The course can also optionally be self-paced to accommodate any schedule.

Once you have all of the systems (and a team) set up, and have acquired your properties, running your rental real estate business really doesn’t take much time at all — often 30 minutes to two hours a MONTH — but it will naturally take more time at first while you’re building your base of knowledge, getting started, and adding properties to your portfolio.

Supposing you were sitting on millions in cash and your only limiting factor for acquiring new properties was time, you could very feasibly be growing your portfolio by four or five properties a year in just a couple hours a week. (With the weeks where you close on a new property taking more like 5 hours.)

Once you have the knowledge and system, you can really knock these things out like bowling pins.

It’s also worth keeping in mind that if you’re ridiculously busy and want something as hands off and easy as possible, there are ways you can modify your approach to sacrifice potential returns in exchange for ease and convenience. (Remember Deepak, the self-proclaimed “lazy investor?” That’s exactly what he did.)

Is this process as easy as Vanguard auto-withdrawing your monthly ETF purchase from your bank account? Of course not.

Is the asset + passive income worth the time it takes to get set up?

Heck yes.

The time you invest here now gets paid back to you down the line through no longer having to work a job every day just to pay your bills.

Your First Rental Property gives you the option of going through the curriculum at the same time as all the other students in your cohort OR going self-paced.

If you want to complete the program in the 10 weeks alongside the other members of your cohort, you’ll probably want to commit 2-5 hours a week, depending on your learning style, speed, and how much you leverage the tools and resources. A small time commitment when you consider all the time you’re going to get back as a result of your earlier retirement.

We offer all of the lessons in audio, video, and text format, so you can fit the learning into your existing schedule — like listening to the YFRP core content while you drive or work out — to make the most of your time.

If you’re super-duper busy and you’re certain that finding a couple hours a week isn’t realistic, even with you matching the learning format to best fit your life, remember that you have lifetime access to ALL of the current and future content, as well as lifetime access to all of our support.

If this sounds like you, know that you’re in good company — you’re what we affectionately call a “turtle,” and many of our students are in the same boat: steadily and consistently chipping away at the curriculum; knowing that their slow and steady pace is the difference between them working towards building an awesome portfolio vs. continuing to stand on the sidelines hoping that “maybe one day” they’ll have the time start taking action.

Remember, the journey of a thousand miles begins with a single step. It’s far more important that you start and take consistent small steps than to feel so pressured to dive in fully that you never find yourself in a good position to actually start taking action.

Yes!

Having a comprehensive guide with all the knowledge you need in one place is going to save you tons of time vs. going it alone and picking tidbits up from blogs and podcasts.

Additionally we have a huge suite of 50+ tools & resources that allow you to shortcut time spent.

Beyond getting lifetime access to the course material, you also get lifetime access to all of our support. Our forums stay open year-round, and our support staff are always available to help you, and you'll be able to join office hours live with Paula for all future YFRP cohorts as part of your lifetime access.

By the way, lessons are available on-demand so you can watch them whenever you want. The only aspect of the course that happens in "real time" is our Office Hours and Study Hall sessions. Both are recorded so that you can watch them later.

Yes! The best deals are found by building a team and investing out-of-state, which you'll be able to confidently do by the time you complete the course.

Yep!

You get access to all the current content, as well as to all of the updates that we regularly make to it.

Additionally, you get lifetime access to all of our tools & resources, our community, and our support.

Yep!

All YFRP students and alumni get lifetime access to all of our support methods and community.

You also get lifetime access to all of our tools & resources, as well as the course content, and all of the updates that we regularly make to it.

Yes. This course is designed for both local and out-of-state investors. Our only assumption is that you live in the U.S. and that you want to invest in residential rental properties anywhere inside the U.S.

Many of our students want to (or need to) invest out-of-state, and we have an entire section in our Find module for out-of-state investors. There are several in-depth lessons that show exactly how I researched Indianapolis before buying a duplex there.

Great question — the answer is a whole-hearted "yes!"

In fact, if you're not quite ready to invest yet, the course is arguably even more helpful for you than if you were actively trying to invest *today*.

Why? Two reasons:

1. Education and preparation pair perfectly with saving for a down payment.

2. If you're a ways out from being able to actively start investing, it can be difficult to maintain excitement and momentum if you're going it alone. The weeks can bleed into years, and before you know it, a decade's passed and you still haven't bought your first rental. By joining YFRP before you're ready to invest, you get instant access to support and accountability to keep yourself moving forward.

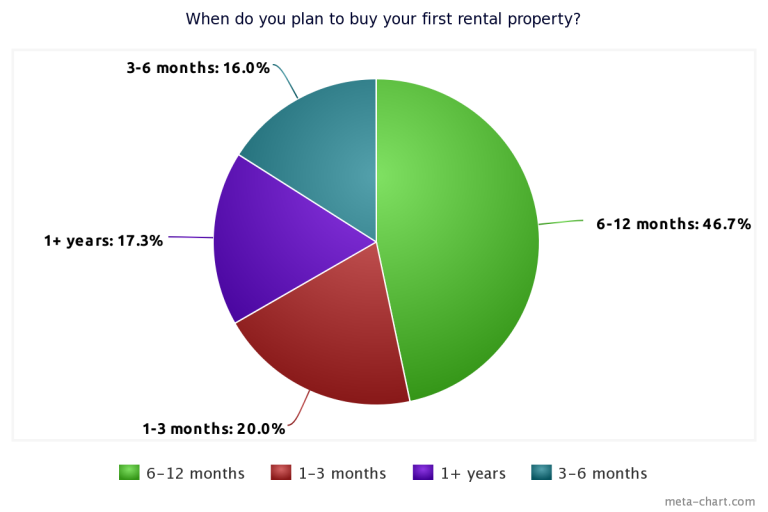

Fun fact, we surveyed our students a couple years ago on when they plan to buy their first rental, and they said…

As you can see, most of the students in the course don’t plan on buying their first rental property right away. They joined because they saw the value in building a solid base of knowledge before they were ready to lay down the cash for a place.

Further, buying the right property is crucial to this process. Rushing to buy a property just for the sake of having one goes against everything I teach in the course.

Getting spared from buying the wrong property is as important — if not more important — than buying the right one.

Yes! The group pacing is an option, not a requirement, and you have lifetime access to the course. You’re welcome to revisit the lessons anytime you’d like, or re-experience the class with a future cohort.

Many students find themselves off-sync with the student cohort midway through the material, usually after they take a vacation or get busy at work — and that’s normal and expected. We call it “Turtle Power.” You’ll see.

Beyond getting lifetime access to the course material, you also get lifetime access to all of our support. Our forums stay open year-round, and our support staff are always available to help you, and you'll be able to join office hours live with Paula for all future YFRP cohorts as part of your lifetime access.

By the way, lessons are available on-demand so you can watch them whenever you want. The only aspect of the course that happens in "real time" is our Office Hours and Study Hall sessions. Both are recorded so that you can watch them later.

We've had many international students in the course who have had a fantastic experience learning the fundamentals of real estate investing. If you're international and you want to learn the principles behind how to analyze deals and become an intelligent real estate investor, this course will help you. But if you're looking for specifics about taxes or financing, we can't help. We can't tell you how to hire a contractor in Malaysia, and we don't know the specifics about banking or financing in Russia. However, what we cover at a high level, you can apply anywhere.

Heitor, a student who lives in France, went through the course and still found it valuable. He says, "If your goal is to buy a house, wherever it is, for an investment, and you're asking yourself if there's any missing piece of knowledge today that blocks you from going and doing it, the course is going to help you clarify each and every point...You get a crystal clear vision on all of the process. And I mean it because I was somewhere else where the process is not the same, but the building pieces are still so well-structured, that you can still sit through and do all the parallels that are necessary to build the base to go on and just crush it."

Here are my questions back to you.

First, how clear is your strategy? Do you have a clear plan for the number of properties you want to acquire, the cash flow and other profits that you want to meet for each property, the speed at which you'll make these acquisitions, and the metrics you'll use?

Second, how efficient are your processes and systems? Are you running a well-oiled machine with a strong team? Could you scale?

The answer to those two questions will shed light into whether you’re operating an efficient system that can continue to grow, in which case you don’t need any course, or whether you could benefit from structure, guidance, metrics, and systems.

That said, because Your First Rental Property is specifically aimed at beginners who are buying their first or second rental property, we DON’T recommend it for experienced real estate investors.

As the name implies (actually, as the name blatantly states), this is for beginners. Don’t enroll if you’re looking for overly-advanced strategies.

That leads to our next commonly-asked question ….

OMG give me a break.

There are no “secrets” shared in the course, and if any of those other “gurus” out there claim that they have “secrets,” they’re shady AF because that’s a gigantic load of baloney hogwash.

There are no “secrets” to real estate investing, just like there are no “secrets” to learning calculus or dental hygiene or trumpet playing.

You don’t take a class because the teacher will reveal (imaginary, nonexistent) “secrets.” You take a class because you want a guided, curated set of lesson plans that covers everything you need to know in logical, sequential order. You take a class because you want support and accountability from the teacher, the teachers assistants, and your fellow students. You take a class for access to the resources, spreadsheets, checklists, word-for-word scripts, email canned responses, and the business-in-a-box setup. You take a class for the quizzes that test your knowledge along the way and provide real-time feedback about your strengths and weaknesses. Duh, that’s what a class is.

That’s why you take classes in high school and college, and that’s why you take classes online.

You don’t take classes because someone is going to teach you the “hidden secrets” to anthropology or statistics or dog training. Right?

So please do me a favor and never believe anyone who claims that they’ll sell you a class that holds the “secrets to real estate success.” Barf. If anyone claims to have these, they’re spammy and they’re lying.

Okay, rant over.

Short answer: that's not what the course is intended for.

Long answer: Maybe.

If you’d like to learn about how to find, analyze, finance and renovate those properties, yes. But if you’d like to learn about the management, staging, furnishing and advertising of those properties, as well as specific vacation rental-related tax and legal implications, no.

My philosophy on vacation rentals is the following:

Have multiple exit strategies. Buy a vacation rental only if it also makes sense as a traditional 12-month rental.

You can earn additional money using it as a vacation rental. But if for any reason you can no longer rent the property on a short-term basis (e.g. if your city council outlaws short-term rentals in your area), you can revert the property to a 12-month rental and still be okay. In other words, you minimize risk by finding a property that could satisfy both uses.

For that reason, the sections in this course on finding, analyzing, financing and renovating apply regardless of your use of the property. But the sections on tenant management would not.

We also don't cover the unique needs of a vacation rental owner, like how to resupply consumables, manage cleaners, monitor utility usage, and handle sales and occupancy taxes.

That said, quite a few students have purchased vacation rentals with the knowledge they gained in the course, but we're primarily focused on long-term, buy-and-hold residential real estate.

Heck NO!! If you are financially struggling, please do not enroll in this course. If you’re stressed about bills and you’re in a tough financial situation, this course is not right for you at this time.

I’ve published hundreds of free articles on my website and 500+ free podcast episodes that can help you save money, earn more, start a side hustle, and get out of high-interest consumer debt. If you’re financially struggling, stick only with my free material. Stabilize yourself first.We recently surveyed our past students, and 48.18% of the respondents have already gone on to acquire one or more rental properties!

Some of our students enroll when they have immediate investment plans, and other enroll knowing they won't be ready for a year or more.

But for the ones that are chomping at the bit to get started, we've noticed that they tend to take the first 3 modules of the course immediately (Analyze, Find, and Finance) and then get started implementing and use the rest of the course as a reference as they need it.

(All students get lifetime access to all of the course materials and support)

It's up to you how you want to utilize YFRP; it's built to be a companion for you on your real estate investing journey, regardless of your style.

Build a team! This course shows you how.

Investing out-of-state (without traveling there) is common. It's been a time-tested practice for years. Many investors purchase properties from out-of-state, using the time and talent of their local team. We’ve been Facetiming, Zooming, and Slacking since before it was cool.

We teach you how to build a team of agents, property managers, inspectors and contractors who will be your eyes, ears and boots-on-the-ground … so that you never have to leave home.

Kaylee

“The most helpful aspect of enrolling in the course was the road map the course provided that helped my husband and I tackle this new-to-us real estate investing venture together.

I’m not sure we would have had the courage to go through with the [duplex] purchase without the course. And I know we wouldn’t be as savvy in our decision-making - and there are a lot of decisions to be made - without the information we got out of this course.”

- Purchased a duplex

Why wait another minute when...?

Just hours inside Your First Rental Property will have you already more educated on spotting deals and opportunities than you ever could have going it alone.

Join Your First Rental Property Now

- With lifetime access available to ALL content and support, direct access to Paula, and a risk-free 7-day money-back guarantee.

Enrollment closes soon:

You missed out!

One-Year Access Pass

Risk-free guarantee

$1,297

payment plans available

Best Value

Best Value

All-Access Lifetime Pass

Lifetime access, risk-free guarantee

$1,597

payment plans available

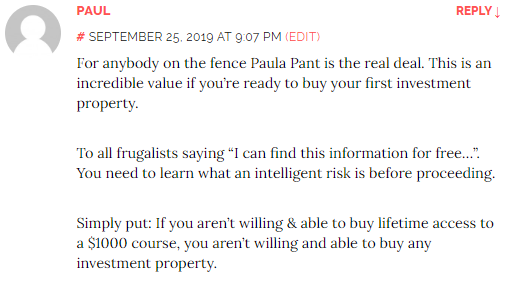

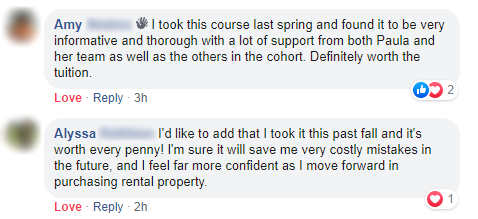

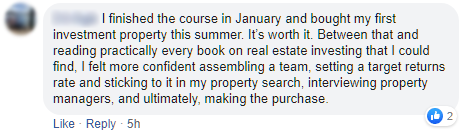

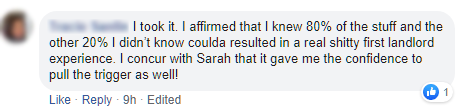

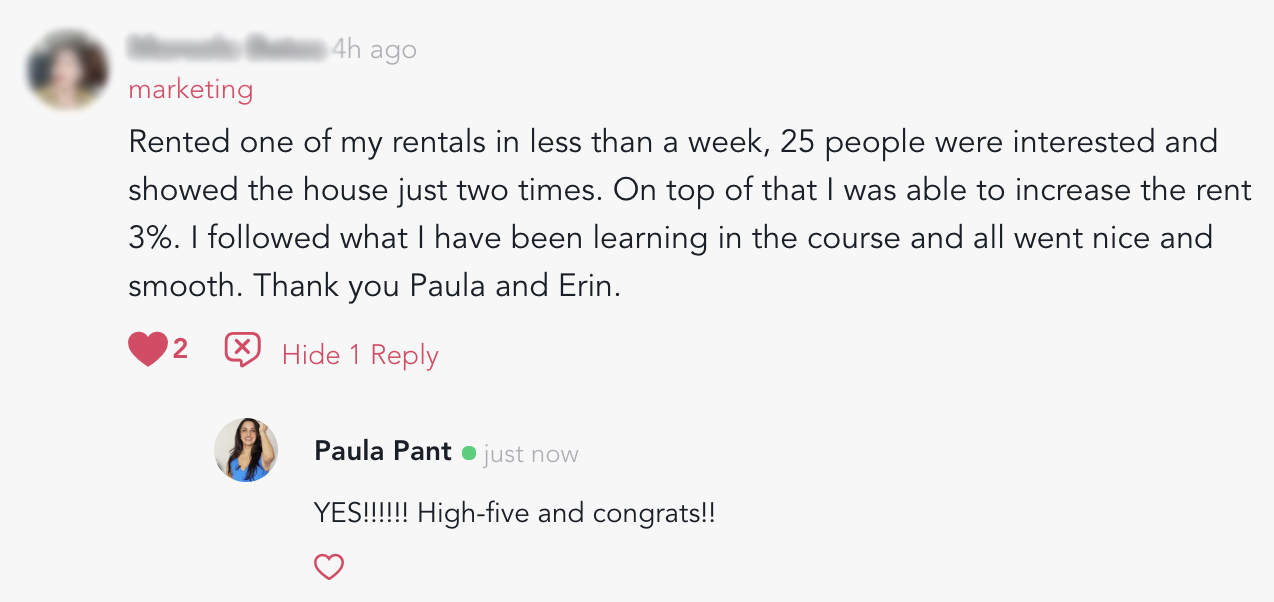

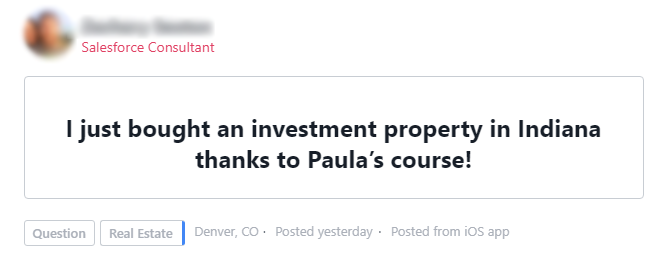

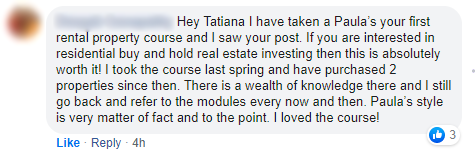

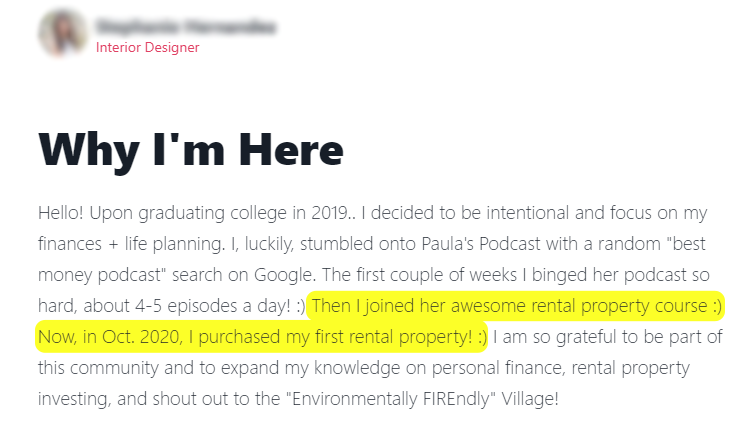

What YFRP Alumni Are Saying Across

Our Communities...

“I didn’t know enough about real estate to have fully formed expectations going into the course, however the end result blew anything I would’ve had in mind out of the water. The level of detail for the immense scope of the course was awesome. The production made the content fun, interesting, and relatable, when it could’ve been textbook dry.”

- Alex Le